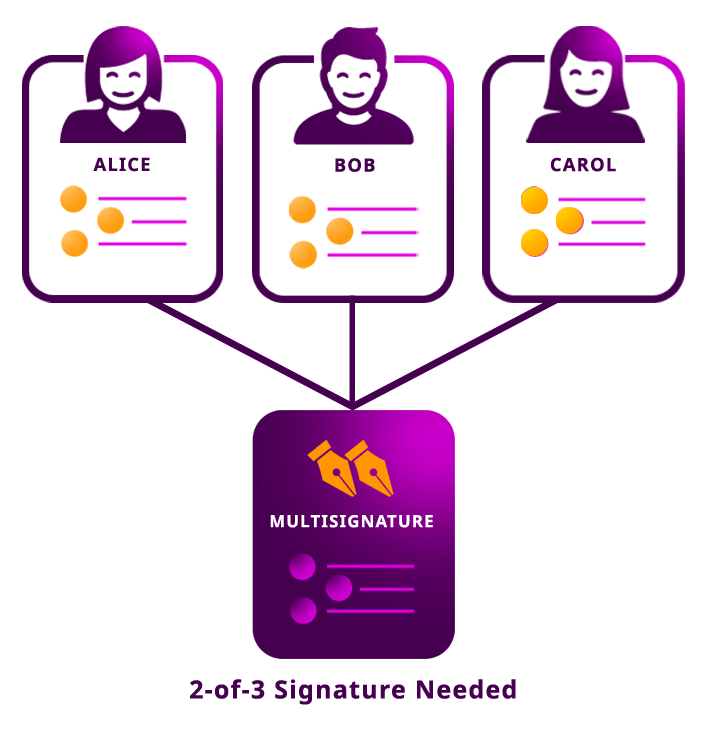

Multisig accounts require additional signatures to initiate actions/transfers.

Symbol accounts can be converted to multisig. The cosignatories—other accounts—of the multisig will become the account managers.

From that moment on, the multisig account cannot announce transactions by itself. A multisig cosignatory has to propose a transaction involving the multisig, wrapping it in an AggregateTransaction.

To record the transaction in the block, the other cosignatories will have to agree.

It is not always necessary to require all cosignatories to cosign transactions associated with the multisig account. Symbol allows to set up the minimum number of cosignatory agreements. These properties can be edited afterward to suit almost all needs.

Symbol’s current implementation of multisig is “M-of-N”, where M is the number of cosignatories required to announce a transaction and N is the total amount of cosignatories for that particular multisig account. This means that M can be any number equal to or less than N, i.e., 1-of-4, 2-of-2, 4-of-9, 9-of-10 and so on.

Similarly, cosignatories can invite other accounts to take part in the multisig, or propose to remove others when the defined conditions are fulfilled.

Note

Multisig accounts are a powerful tool, but please use this tool with caution. If the cosignatories keys get lost and minimum approval is not reached, it would result in the permanent loss of access to the funds held by the multisig account. Choose minimum removal parameter wisely to avoid this situation.

The public network defines the following constraints for multisig accounts, being the values presented configurable per network.

Multisig accounts can have up to 25 cosignatories.

An account can be cosigner of up to 25 multisig accounts.

Multisig account can be a cosigner for another multisig account, up to 3 levels. Multi-level multisig accounts add “AND/OR” logic to multi-signature transactions.

Multisig modification transactions must be wrapped in an AggregateTransaction. New cosignatories added to the multisig must opt-in by cosigning the aggregate.

There is a broad range of useful applications for multisig accounts. Let’s take a look at some of the most common use cases.

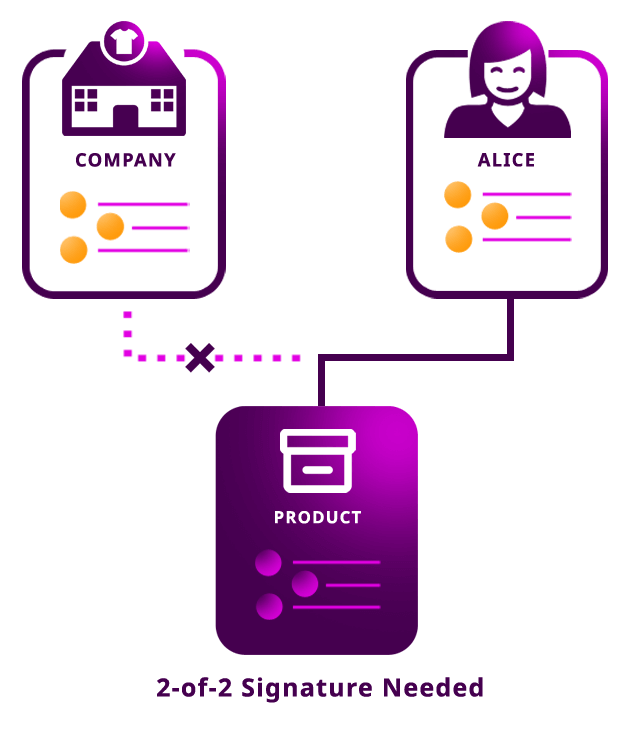

Multisig accounts can be used to represent the ownership of assets.

A company could create a 1-of-1 multisig account for each of their products, adding themselves as the cosignatory. When the company sells the product to Alice, she becomes the owner through the action of being added as the cosigner, and the company is removed in the same transaction.

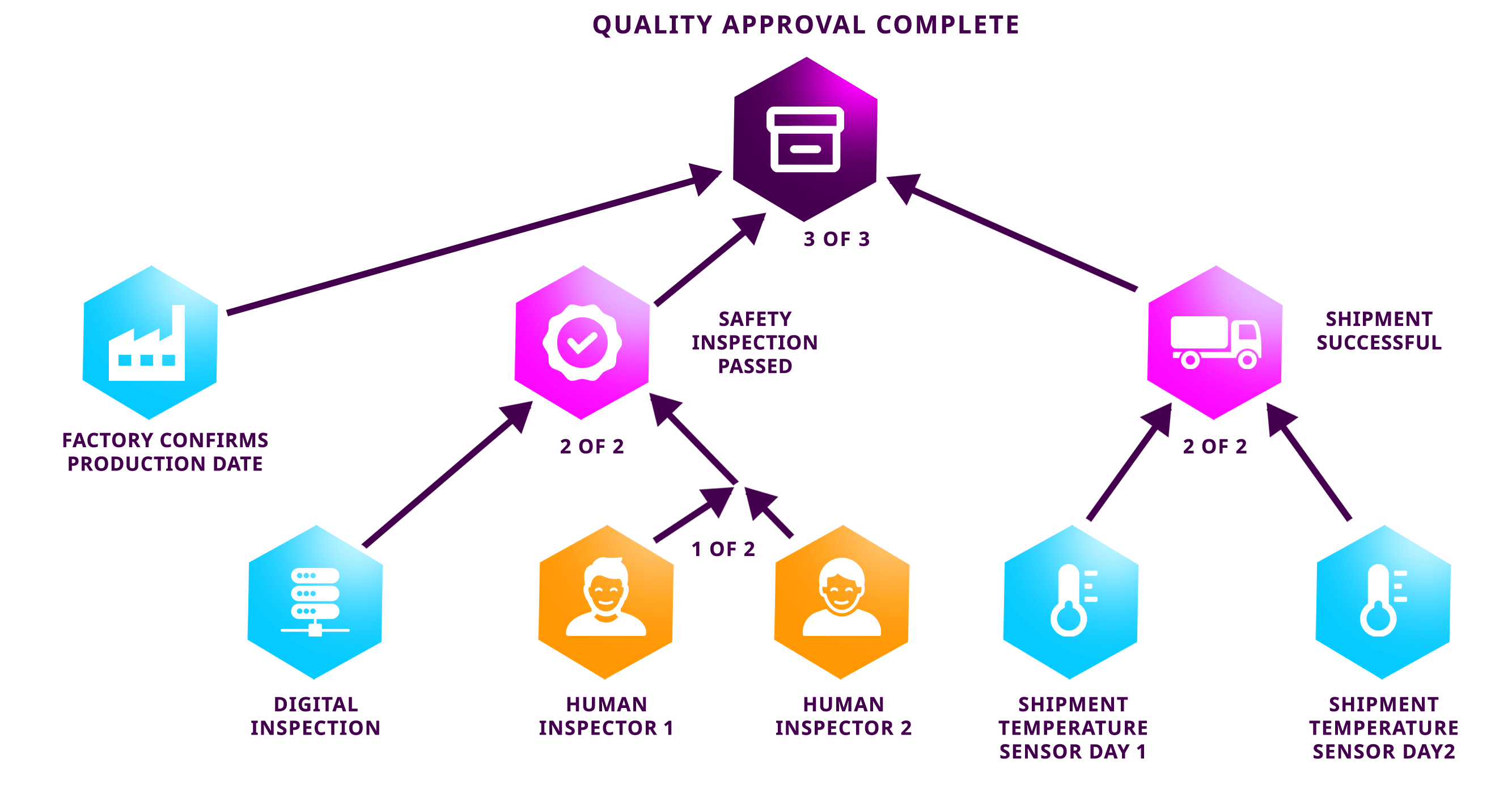

In this example, a manufacturer is shipping a pharmaceutical product.

The product receives its quality approval mosaic only when its blockchain record shows it has a production date, safety inspection, and was shipped at the correct temperature.

Sensors in the shipping container report temperature data every 5 minutes and consolidate it into a daily report.

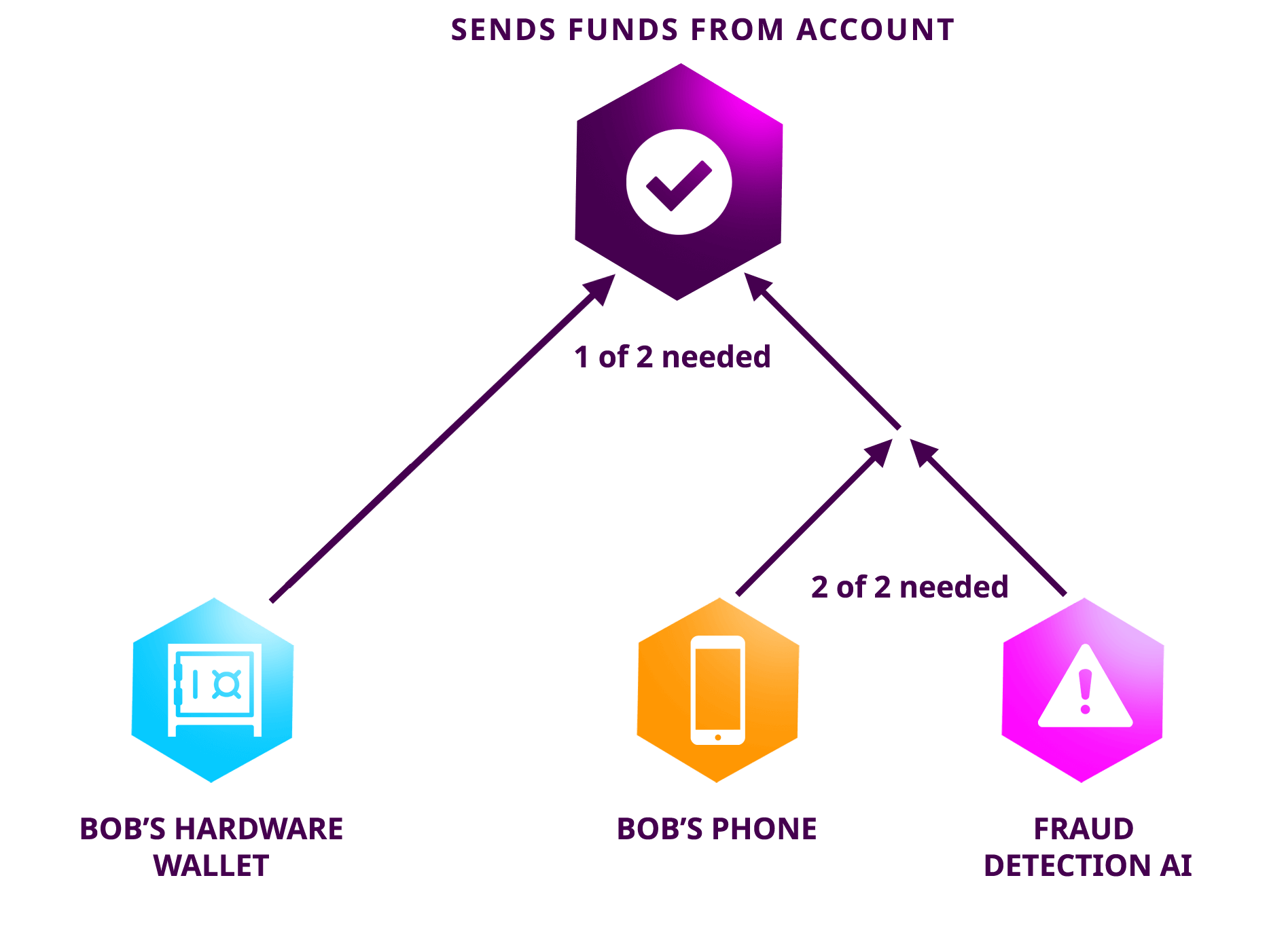

This example shows how a high-security account can be made easier to use.

Transactions are only approved from a hardware wallet OR your phone AND a fraud detection AI. MLMA allows a variety of security configurations at the protocol level to keep businesses and their customers hack-free.